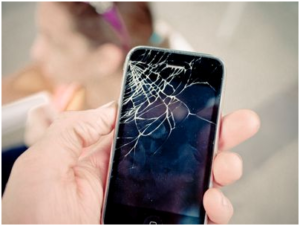

iPhone Accidental Damage Insurance: Compare and Buy Best One Online

iPhone Accidental Damage Insurance: iPhone protection plans are available online for comparison and also to buy. You can protect your iPhone from theft, loss, or damage; you have to opt for the right insurance plan for it. Usually, iPhone insurance plans and extended coverage are costly, but again the right plan can save you a lot down the line if unfortunately your phone gets damaged, lost, or stolen. Here we will discuss “How to pick the best iPhone accidental damage insurance”.

There are plenty of phone protection plans available, but you have to consider several aspects while choosing a plan. Extended warranty plans cover repairs only and don’t include mechanical failure, accidental damage, loss, or theft. Some of the plans cover accidental and mechanical failures but do not provide coverage for loss or theft. So which is the best iPhone insurance plan for you?

There are plenty of phone protection plans available, but you have to consider several aspects while choosing a plan. Extended warranty plans cover repairs only and don’t include mechanical failure, accidental damage, loss, or theft. Some of the plans cover accidental and mechanical failures but do not provide coverage for loss or theft. So which is the best iPhone insurance plan for you?

Before deciding on an insurance plan, you need to consider how you use your iPhone, its cost, and the risks associated with it. You also can think of add-on coverage such as phone replacement service, worldwide coverage, etc.

Consider what coverage you already have

If you provide Multi-Policy coverage, you get a cheaper deal. You can have an affordable and flexible package that covers your laptop, tablet iPhone, etc.

An affordable and comprehensive policy is not the only thing you have to look for, you also have to look for something closer to your home. Apple provides 12 months warranty period which covers manufacturing defects. AppleCare+ replacement if accidental damage is caused.

You can also get your iPhone covered under your home contents insurance which covers your personal possessions for damage, theft, or loss; it will include your iPhone too.

There are very few insurers that provide coverage for viruses as well as for unauthorized data costs.

Insurance from Retailers

Many retailers who sell iPhones offer iPhone insurance at a much more affordable price. The plans are flexible and provide different coverage options such as a plan which covers malfunction, coverage for accidental damage plan that covers theft or loss, coverage that includes mechanical failure, etc. The more comprehensive coverage you have, the higher the price.

Insurance from Mobile Carriers

Most mobile careers offer phone coverage plans for accidental damage, loss, theft, out-of-warranty malfunction, etc. Usually, you have to get your phone covered within 30 days of a phone activation or upgrade. You will have to pay a deductible when you make a claim. The plans offered are much more flexible and affordable.

Insurance Coverage from Credit Card Issuers

The majority of credit cards provide an extended manufacturer’s warranty for a phone for a year or more; it varies with the card. Some of them also provide coverage for loss as well as theft if occurred within 90 days from purchase. Some of the cards protect your phone from theft and damage coverage if you pay for your phone services using the card.

Homeowners/Renters Insurance

Some of the insurance companies attach a rider to your homeowners/renters insurance. It might cover your iPhone; you check with your provider about it. Read more articles on lookup.

More Related Queries:

- Compare Smartphone Insurance/ applecare

- Best iPhone insurance plan 2022

- iPhone X insurance cost/ Protection Plans