If you’re considering getting braces, you’re probably wondering about the costs involved, especially when it comes to the down payment. Dental treatments can be expensive, but with proper insurance coverage, the financial burden can be significantly reduced. In this article, we’ll break down the factors that influence the down payment for braces with insurance and provide insights into making an informed decision.

Introduction

A beautiful smile can boost your confidence and overall well-being. Braces are a common way to achieve a straighter smile, but before embarking on this journey, it’s essential to understand the financial aspects, particularly the down payment required when using dental insurance.

The Importance of Orthodontic Care

Orthodontic treatment goes beyond aesthetics; it plays a crucial role in improving oral health by correcting misaligned teeth, enhancing bite functionality, and preventing potential dental issues down the line.

Understanding Dental Insurance Coverage

Dental insurance can help alleviate the financial strain of orthodontic treatment. However, it’s essential to comprehend the terms of your coverage, including what percentage of the treatment cost is covered and any limitations or waiting periods.

Factors Affecting the Down Payment

The down payment for braces can vary based on factors such as the type of braces, your insurance coverage, the orthodontist’s pricing structure, and your location.

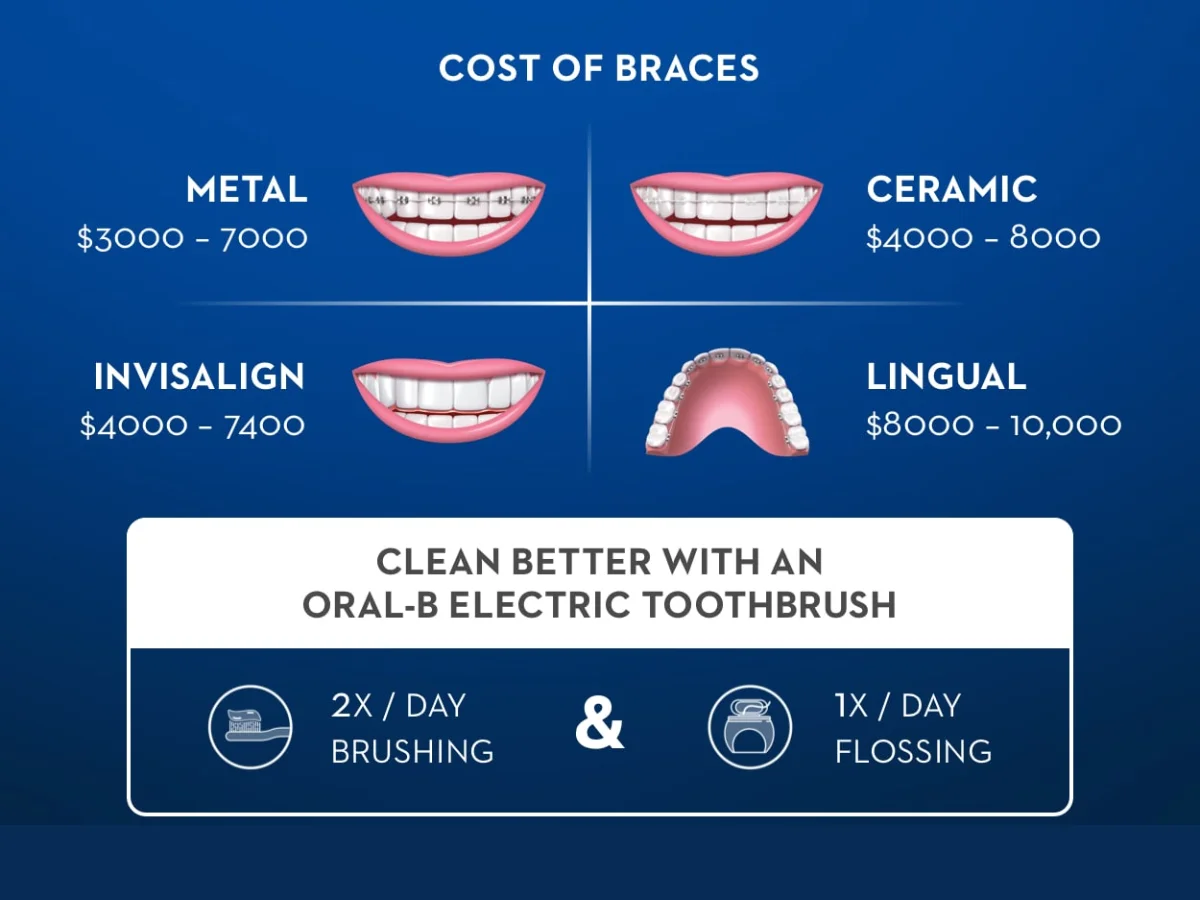

Types of Braces and Associated Costs

Different types of braces, such as traditional metal braces, ceramic braces, and clear aligners, have varying costs. Your choice of braces will impact the overall expense of the treatment.

Consultation and Treatment Planning

Scheduling a consultation with an orthodontist is essential to determine the specific needs of your treatment and receive an accurate estimate of the total cost, including the down payment.

Maximizing Insurance Benefits

Understanding your insurance benefits is key to minimizing out-of-pocket expenses. Some insurance plans may cover a higher percentage of the cost if you choose an in-network provider.

In-Network vs. Out-of-Network Providers

Choosing an in-network orthodontist can lead to more cost-effective treatment, as these providers have agreements with your insurance company that often result in reduced fees.

Negotiating Payment Plans

Orthodontists may offer flexible payment plans to ease the financial burden. Discussing your budget and needs with the orthodontist can lead to a customized payment plan that works for you.

The Role of Flexible Spending Accounts (FSAs)

FSAs are pre-tax accounts that allow you to set aside funds for medical expenses. Using an FSA can provide tax savings when paying for orthodontic treatment.

The Power of Research

Comparing quotes and researching different orthodontists can help you find the best combination of quality and affordability for your treatment.

Is Orthodontic Coverage Worth It?

Considering the long-term benefits of orthodontic treatment, having insurance coverage can make the investment well worth it, both for your oral health and your confidence.

Conclusion

The down payment for braces with insurance coverage can vary based on multiple factors. By understanding your insurance terms, exploring payment options, and conducting thorough research, you can make an informed decision that aligns with your budget and dental needs.

Frequently Asked Questions

- What percentage of orthodontic treatment does insurance typically cover?

Insurance coverage can vary, but it often covers a percentage of the treatment cost, usually ranging from 20% to 50%. - Can I negotiate the down payment with my orthodontist?

Yes, many orthodontists offer flexible payment plans and are willing to work with patients to find suitable arrangements. - How can I find in-network orthodontists?

You can contact your insurance provider or visit their website to find a list of in-network orthodontists in your area. - Can I use a flexible spending account (FSA) for orthodontic treatment?

Yes, FSAs can be used to cover orthodontic expenses, providing a tax-efficient way to pay for treatment. - Is dental insurance worth it for orthodontic coverage alone?

If you require orthodontic treatment, having insurance coverage can significantly reduce your out-of-pocket expenses, making it a valuable investment.